Undercoating and Rustproofing: Essential Protection for Coastal and High-Humidity Regions

Posted on 2026-03-06 11:48:31

Undercoating and Rustproofing for Cars: Essential Protection for Coastal and High-Humidity Regions

24*7 Claim Notifications

100% Paperless

Best Claim settlement Awards 2022

Undercoating and Rustproofing: Essential Protection for Coastal and High-Humidity Regions

Posted on 2026-03-06 11:48:31

Undercoating and Rustproofing for Cars: Essential Protection for Coastal and High-Humidity Regions

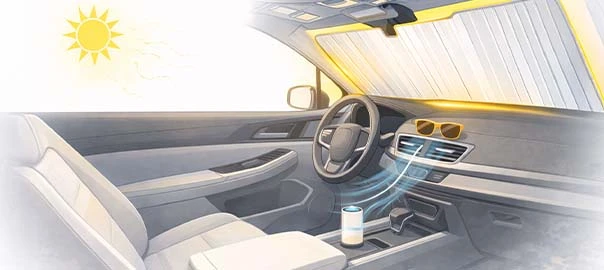

How to Protect Your Car Interior from India Extreme Summer Heat

Posted on 2026-03-06 11:30:53

How to Protect Your Car Interior from India’s Extreme Summer Heat

Best Cars for Weekend Warriors: Vehicles That Balance Daily Commute and Adventure

Posted on 2026-03-05 09:29:06

Best Cars for Weekend Warriors: Vehicles That Balance Daily Commute and Adventure